BRIDGE LOAN

ACCESS YOUR HOME'S EQUITY AND FIND

YOUR DREAM HOME

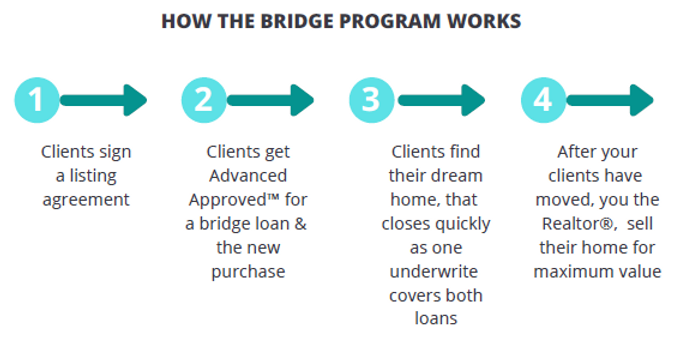

A bridge loan is a short-term loan that uses the equity from your current home to help you make an offer on a new one, without rushing to sell. Beyond offering competitive rates, our partner RPM Mortgage has created loan products that exclude the debt of the departing property, putting Bridge Loans in the reach of more homeowners. They also fully underwrite the loan in advance, giving you peace of mind.

WHAT ARE THE DETAILS

-

680 Minimum Credit Score

-

70% “Combined” Loan to Value (CLTV) via exterioronly appraisal

-

$50k Min Loan - $400k Max (facilitates 20% down on new $2MM purchase) - 2nd Position purchase loan (no exceptions)

-

Client must work with RPM for the bridge & new Only

-

6% rate, 6-month loan term, 1 pt. fee, interest only (I/O) payments

-

6 months extensions available for 1 pt. fee upon expiration & subject to RPM review (rate stays the same)

-

Must sign listing agreement with certified realtor prior to closing

-

To qualify, Bridge Loan get recorded against the property, and must be in 2nd position.

DOES A BRIDGE LOAN MAKE SENSE FOR YOU?

-

Do you have equity in your current home?

If you need to leverage money that is tied up in the equity of your current home, a bridge loan can help by securing funding to move you into a new home. Bridge Loans help with things like a down payment or mortgage payments. Once your current home sells, you can use the proceeds to pay the bridge loan back.

-

Do you need to move by a certain time?

If you're relocating, a bridge loan can help you secure a new home when you need to, without having to wait for your old home to sell.

-

Does your home require renovations or other work?

Construction work can be done more easily when you have moved out of the house, which enables a faster sell!

Ask your agent about Property Enhancement Loans thru RPM Mortgage, with rates as low as 0.01%, NO points, and with a 6-month term.

Compliments of Meghan Diehl Walnut Creek Realtor